|

|

What's Next for the Provider Supply Chain Organization?Organizational design is a topic that brings out a certain degree of gossipy interest in the supply chain professional. “What is Apple’s supply chain organizational model? What about P&G and Unilever? Amazon?” Implicit in these questions is a sense that if a company could only copy the organizational structure of one of these supply chain titans, then performance would follow. The reality isn’t this simple obviously. Organizational design is inseparable from business strategy. Or at least it should be. In many cases, organizational design is nothing more than a reflection of how an organization chooses to manage people and resources. This is the classic inside out approach to organization design—a structure that makes it easy on management but adds no value to the customer. Centralized? Decentralized? Matrixed? What are the broad parameters of organizational design? While the descriptions may vary, there are typically three types of organizational structures: centralized, decentralized, and matrixed. Centralized organizational structures provide a great deal of control and allow for benefits of scale. Cost control and standardization efforts excel in centralized organizational structures. However, these organizations can move slow and have issues providing differentiated service to the customer. Decentralized organizations flip this dynamic. They tend to be highly responsive to the customer. With this responsiveness, however, comes higher costs. Redundancies also may flourish in organization’s with decentralized supply chains. Matrixed, or center-led organizations are focused on balancing these two objectives: keeping costs in control while providing differentiated service to customer segments. The goal is agility. Needless to say, this can be the most complex structure to manage since it is dependent upon cross functional collaboration and shared accountability.

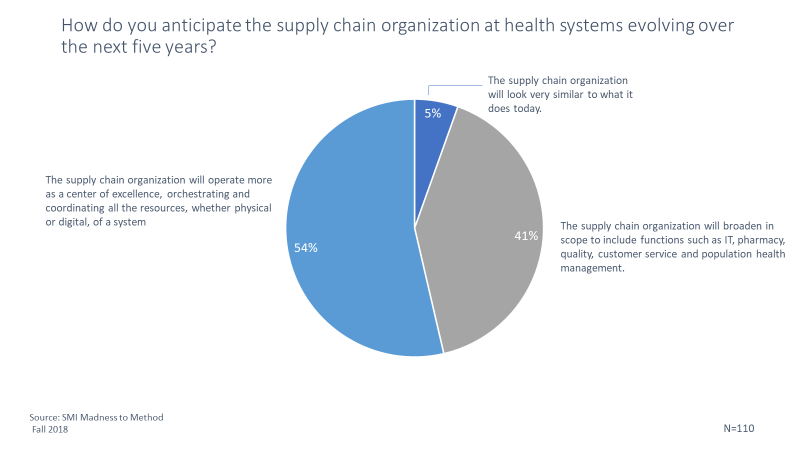

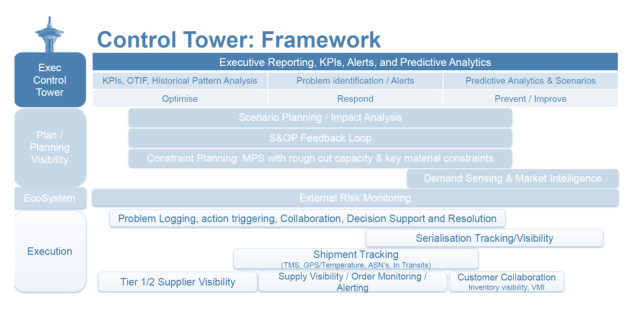

I find this data fascinating for a number of reasons. First, almost no one expects the supply chain organization to stay the same as it is today. There is clear recognition that organizational structure is not static and fixed but must adapt to the new realities of the business and to support shifts in strategy. Second, we see support for both greater centralization as well as more of a center-led or matrixed organizational model. A fairly large percentage expect supply chain to take on more direct accountability for functions that currently lie outside of its remit—perhaps driven by cost control and standardization strategies. The largest percentage, however, expect supply chain to gravitate towards a more center-led model in the form of a center of excellence. Rise of the Center of Excellence One trend that has been on the rise for many years in industries outside of healthcare is the adoption of centers of excellence as key enablers of end to end supply chain planning and execution. While CoE’s can take many different shapes and support many different business processes, the one I’m interested in here is the “control tower,” which I think is most similar to the description selected by 54% of respondents. The layers within a control tower can range from longer range planning all the way to daily execution. The graphic below depicts this for a large pharmaceutical manufacturer.

Decision making in control towers tends to move at a faster pace since it has been dispersed across the multiple layers. This means not every decision needs to be blessed by executive leadership. Moreover, the analytical strength that tends to emerge within control towers allows for much more proactive management of risk. It’s at this level that agility can begin to take root in the supply chain. Consider the case of Unilever, which operates its North American control tower out of Shelton CT. Customers on the East Coast were expecting a shipment of temperature sensitive product from the Western US within a two-delivery window. After the product shipped, the control tower quickly realized a massive storm developing in the Midwest. They were able to divert the product away from the storm, and then tap into spare trucking capacity through an e-freight partner to ensure the product was delivered within the 2-day delivery timeframe. In an industry that has been beset by product shortages over the past five years, a fully connected control tower that links trading partners is worth exploring. As always, we welcome your comments and suggestions. |

|

© Strategic Marketplace Initiative | PO Box 1318 | Westborough, MA 01581 | United States | 508 - 732 - 0059 | [email protected] |