|

|

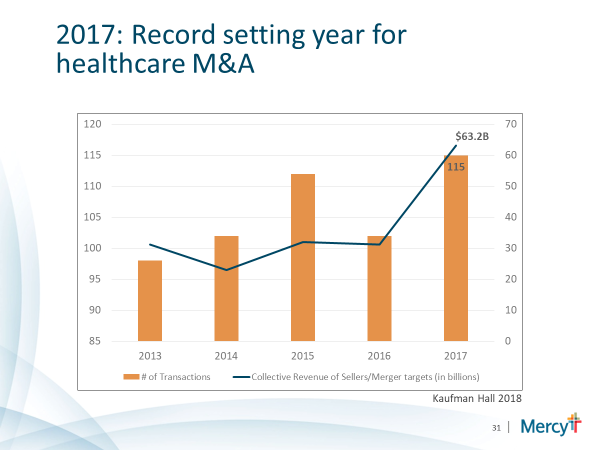

The Room Where It HappensLate in the smash Broadway musical, Hamilton, Aaron Burr sings a number that starkly reveals the source of his ambition. Singing about the deal Hamilton cuts with Jefferson and Madison to ensure a strong national treasury in exchange for locating the capital in the South, Burr laments not being "in the room where it happens". The fact that he didn't participate in the meeting where this compromise was made eats away at Burr. What motivates him? His legacy and the ambition to be at the center of the strategic decisions that will shape the future of the young Nation. When it comes to perhaps the most strategic decision an organization can make, namely whether or not to acquire another company, I wonder if supply chain executives feel similarly to Burr? Do they want more of a say in these deals that are only increasing in frequency? Do they want to be in the room where it happens? The M&A Train Keeps A-Rollin' During our Fall Forum, Dr. Li Ern Chen highlighted the tremendous contraction happening across healthcare today. In fact, 2017 was a record setter in terms of health system M&A activity.

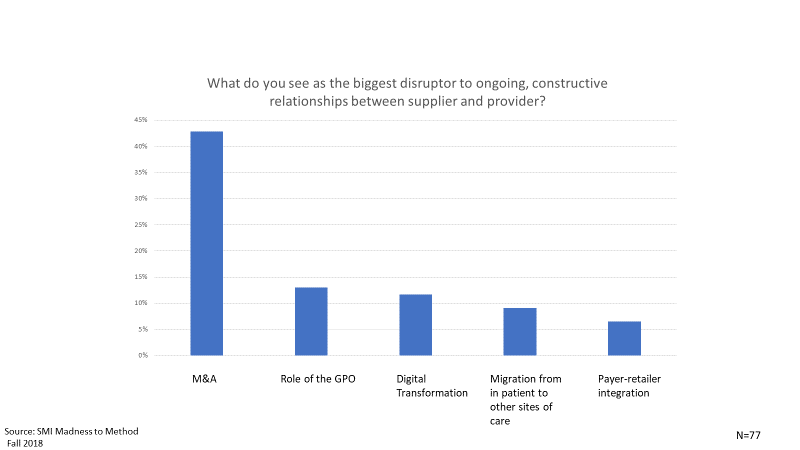

While some of this action involves smaller systems, there are also some very large mergers in the works, including Catholic Health Initiatives and Dignity Health and Baylor Scott and White with Memorial Hermann. These are huge and transformative mergers, and as can be imagined, have garnered increased scrutiny from both state and federal regulators, and of course the press. For instance, a recent article in the New York Times questions the logic that these mergers are reducing cost and adding value to the health system at all. See When Hospitals Merge to Save Money, Patients Often Pay More. The Times article focuses predominantly on the downstream cost impact on insurers and consumers, but what about potential upstream cost savings due to economies of scale, and greater leverage with suppliers? Here the picture isn't as rosy either. According to a rather technical academic working paper by the Wharton School (and supported by purchasing data provided by the ECRI Institute) acquiree hospitals can objectively assume "saving 10 percent of the amount that might be claimed in a merger justification, and acquirers saving 0 percent." (Craig et al. 2018) In short, the value expected from "supply chain synergies" may be unrealistic and may place unrealizable goals on the supply chain professionals at the front end of M&A implementation. The Disruptive Nature of M&A According to polling data collected at our Fall Forum, the SMI community sees increasing M&A activity as the number one potential disruptor to supplier-provider relationships.

Reasons for this perspective may be fairly obvious. It can take years to develop relational trust between parties; the merged entity may involve new relationships, new strategies for growth, and new perspectives on value; the culture of the merged entity may be unfamiliar. At the very least, both parties will require time to learn anew. One of the best metaphors I’ve heard for the messy reality of merger and acquisitions came from the M&A lead for a healthcare organization that was selling its consumer health business to another entity. He said that many people had the impression that M&A consisted of simply unplugging a business from your company and then plugging it into the acquiring company. This was wrong. It was more like trying to rip a piece of taffy in half. You had all these gooey strands that never broke cleanly and it was up to the supply chain organization of the acquiring company to then thread those broken strands together. So what can a supply chain executive do to lessen this painful reality? Demanding a role in the decision-making process is probably not the way to go. I imagine that this is earned over the course of successful integrations. Gary Fennessy CSCO of Northwestern Medicine shared his perspective at the Fall Forum on recent acquisitions by Northwestern. His organization was able to shrink a 14 to 18-month integration process to four months with Northwestern’s latest acquisition of Centegra. That is a remarkable reduction in implementation time. Adding that degree of value, at least in my view, should get supply chain closer "to the room where it happens". As always, we welcome your comments and suggestions. |

|

© Strategic Marketplace Initiative | PO Box 1318 | Westborough, MA 01581 | United States | 508 - 732 - 0059 | [email protected] |